If your North Carolina house is in pre-foreclosure, there are several options you can explore to try to save your home and avoid becoming homeless. Depending upon your specific situation, then amount of money owed and NC state laws, Here are some steps you can take:

- Communicate with your lender: Contact your lender as soon as possible to discuss your situation. Explain the reasons for your financial hardship and inquire about any available alternatives to foreclosure. Some options might include loan modification, forbearance, or repayment plans.

- Seek foreclosure prevention counseling: Reach out to a HUD-approved housing counseling agency in your area. These agencies provide free counseling services and can help you understand your options, negotiate with your lender, and develop a plan to avoid foreclosure.

- Understand North Carolina foreclosure laws: Familiarize yourself with the foreclosure process and timeline specific to North Carolina. This knowledge can empower you to navigate the situation more effectively and make informed decisions.

- Consider refinancing: If possible, explore the option of refinancing your mortgage. Refinancing can help lower your monthly payments or provide more favorable terms, making it easier for you to afford your home.

- Apply for assistance programs: Check if you qualify for any government assistance programs aimed at preventing foreclosure. The North Carolina Housing Finance Agency offers programs like the Home Protection Program (HPP) that may provide financial aid to eligible homeowners.

- Negotiate with your lender: Work with your lender to find a solution that allows you to stay in your home. This could involve modifying the terms of your loan, extending the repayment period, or finding alternative arrangements that suit your financial situation.

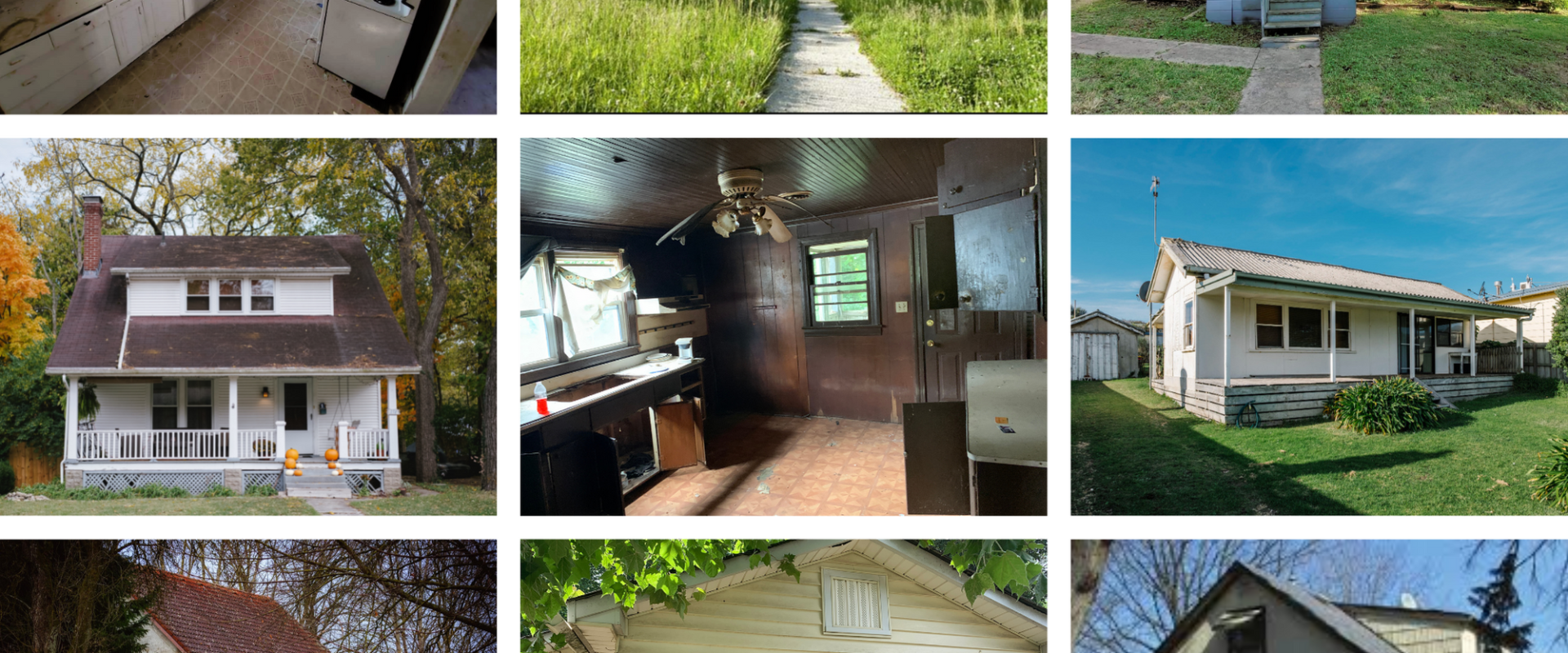

- Sell the property: If keeping your home becomes unfeasible, you may consider selling the property. This option allows you to regain some control over the situation and potentially pay off the mortgage before foreclosure occurs. Consult with a real estate agent to assess the market value and explore selling options. One thing to note here is that if you sell your house on open market, the potential buyers might get to know of the foreclosure situation and therefore can avoid to place an offer thereby delaying the selling process. In this situation, sometimes it is best to consult a local cash buyer. A local cash buyers generally have hard cash in hand and therefore can close on the property generally in 2-3 weeks thereby giving you better chance of saving the foreclosure. Also, local cash homebuyers are investors who generally deal with foreclosure houses and therefore they are aware of all the risk or potential liens associated with it. If you decide to sell your house to a local cash homebuyer, please fill this quick form and we will give you an offer on your property in 24 hrs and get your house out of foreclosure.

- Explore foreclosure alternatives: Investigate foreclosure alternatives such as a short sale or deed in lieu of foreclosure. These options involve working with your lender to sell the property for less than what is owed on the mortgage or voluntarily transferring the property to the lender to avoid foreclosure.

- Consult with legal counsel: If you’re facing foreclosure, it may be wise to consult with an attorney who specializes in foreclosure and real estate law. They can provide guidance tailored to your specific situation and ensure your rights are protected throughout the process.

Remember, it’s crucial to take action promptly when facing foreclosure. The sooner you address the issue, the more options you may have available to save your home or find a suitable alternative. Contact us and we will happily work with you to explore all the options to save your house from foreclosure or to position you better on the other side.